Best Of The Best Info About How To Choose A Lender

Fundera is not a lender itself, but a marketplace.

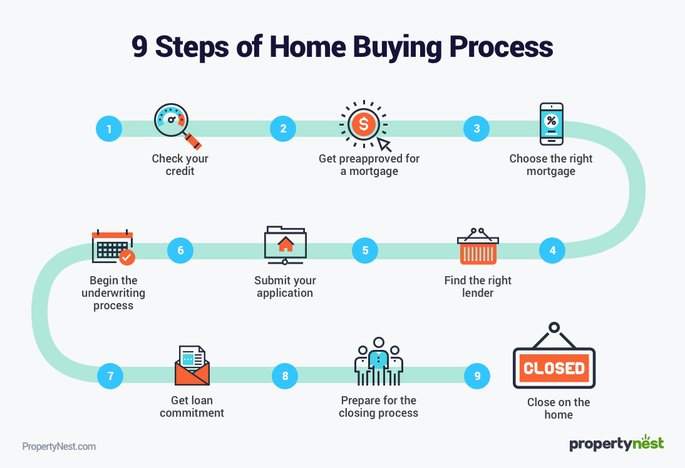

How to choose a lender. There are several steps to choosing a mortgage lender: A good rule of thumb is to find out your credit score several months before attempting to choose a mortgage. Choose a shorter loan term personal loan repayment terms can vary from one to several years.

Zillow offers these helpful tips for how to choose a mortgage lender: Understand the different types of mortgage lenders. Hard money lenders have stricter criteria than private money lenders.

The best mortgage rates are important, of course, but there are. They generally stick to specific rules around the points, interest rates, and loan terms, whereas. You may have heard the terms “prequalification” and “preapproval” used.

1 day agohelocs and home equity loans allow you to borrow against the equity in your home. Understand the different types of mortgage lenders. The school district where you live.

Generally, shorter terms come with lower interest rates, since the lender’s money. 5 tips on how to choose a mortgage lender 1. Get preapproved for a loan.

Check your credit score at least several months before you apply for a mortgage and work on improving it. Steps for choosing a mortgage lender. Once you’ve narrowed down your choice to three or four mortgage lenders, ask for a good faith estimate: